E-Invoicing 2026

Valentina

@ivalentinaAn electronic invoice is not a plain PDF sent by email, there is more to it. An E-Invoice is a structured, machine-readable invoice that complies with EU standard EN 16931 and can be automatically processed by accounting systems and tax authorities.

In our previous blog post, we explained what E-Invoicing is and why the EU is introducing it.

Now we’ll answer the most common questions business owners and managers are asking:

- Is E-Invoicing mandatory in 2026?

- Which EU countries have E-Invoicing deadlines?

- What does E-Rechnung Pflicht mean for German businesses?

- How can I stay compliant without changing my entire invoicing process?

E-Invoicing 2026: What Is Changing in the EU?

The main driver behind the new rules is the EU initiative VAT in the Digital Age (ViDA). Its goal is to digitize VAT reporting, reduce tax fraud, and standardize B2B E-Invoicing across all EU member states.

Key points business owners should understand:

- The EU defines technical standards (EN 16931)

- Each country sets national deadlines

- PDF invoices will no longer be sufficient for many B2B transactions

- Structured formats such as XRechnung, ZUGFeRD, UBL/CII, or Peppol BIS will become the norm

- For companies working internationally, early preparation is essential

E-Invoicing Deadlines in EU Countries

Below you can find a practical short overview of upcoming E-Invoicing requirements in Europe, starting with Germany and Austria — the most searched markets for “E-Rechnung 2026”.

| Country | Status & Timeline | Scope | Formats / Systems | Notes |

|---|---|---|---|---|

| 🇩🇪 Germany | Jan 2025: E-Invoicing mandatory for domestic B2B (receive). 2027: Gradual obligation to issue. 2028: Almost all B2B | B2B | XRechnung, ZUGFeRD (EN 16931 compliant) | 2026 is the preparation year for software & workflows |

| 🇦🇹 Austria | Mandatory for B2G only. No general B2B mandate in 2026 | B2G | ebInterface, UBL | Closely aligned with EU ViDA; B2B mandate expected |

| 🇫🇷 France | Sep 2026: Large companies. Sep 2027: SMEs & micro-businesses | B2B + E-Reporting | Certified PDP platforms | One of the most advanced systems in the EU |

| 🇧🇪 Belgium | Jan 2026: Mandatory | B2B | Peppol BIS 3.0 | PDF invoices no longer compliant |

| 🇵🇱 Poland | Feb 2026: Large companies. Apr 2026: SMEs | B2B | KSeF | All invoices must pass through the government system |

| 🇬🇷 Greece | Feb 2026: Large companies. Oct 2026: All others | B2B | myDATA / real-time reporting | Strong focus on VAT & real-time transmission |

| 🇫🇮 Finland | No new B2B mandate for 2026 | B2G + B2B (widely used) | Peppol, national XML standards | Market-driven adoption already very high |

| 🇪🇸 Spain | Planned rollout 2027–2028 (large companies first) | B2B | Facturae, VeriFactu | Strong integration with digital VAT reporting |

| 🇵🇹 Portugal | Certified software already mandatory | B2B | SAF-T, XML / UBL | Emphasis on software certification & tax reporting |

| 🇳🇱 Netherlands | Mandatory B2G already in force. No B2B mandate for 2026 | B2G | Peppol BIS | Strong Peppol adoption; B2B mandate expected post-ViDA |

Kimai’s New E-Invoicing Feature: Compliance Made Easy

Choosing the right E-Invoicing software is essential to stay compliant and avoid rejected invoices.

With the new plugin and already available in the Cloud, Kimai supports e-invoicing — so you can stop worrying about invoice formats and start focusing on your business.

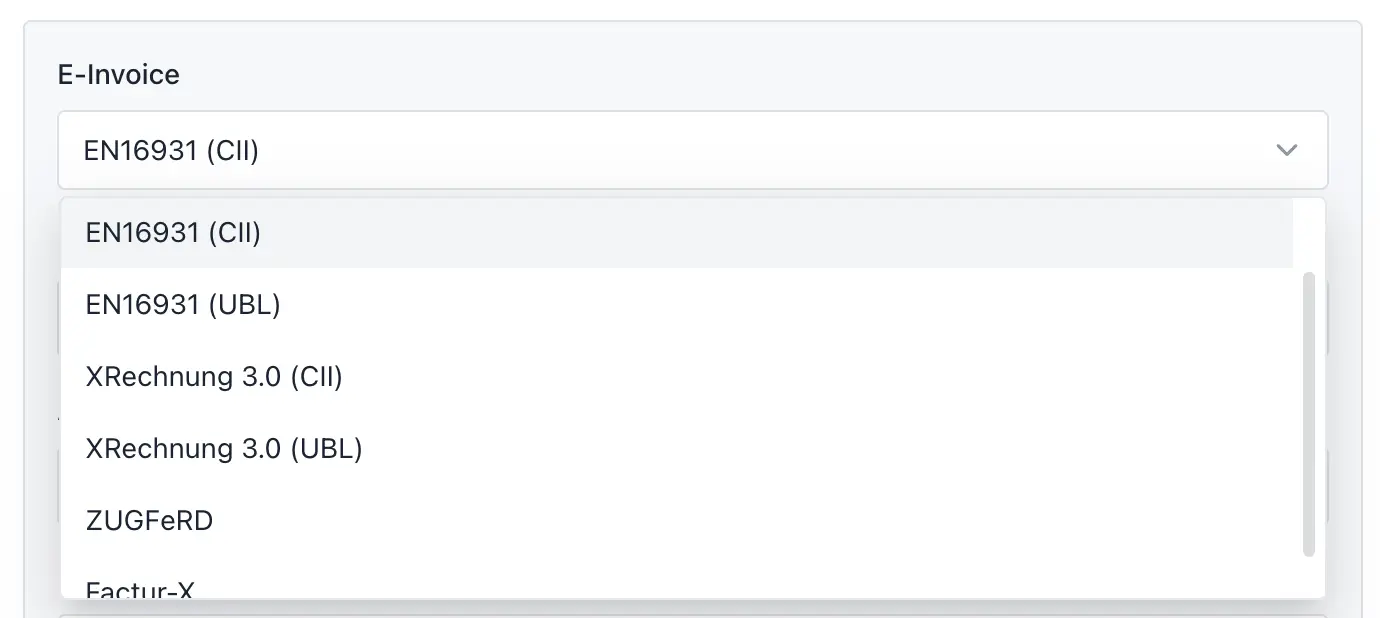

Supported profiles:

- EN16931 - CII (XML)

- EN16931 - UBL (XML)

- Extended - CII (XML)

- Extended - UBL (XML)

- Peppol - UBL (XML)

- XRechnung 3.0 - CII (XML)

- XRechnung 3.0 - UBL (XML)

- Zugferd - CII (PDF/A hybrid with embedded XML)

- Zugferd - UBL (PDF/A hybrid with embedded XML)

- Factur-X - CII (PDF/A hybrid with embedded XML)

- Factur-X - UBL (PDF/A hybrid with embedded XML)

Key features for EU businesses:

- Automatic e-invoice generation: Create PDF invoices via plugin or in Kimai Cloud; required machine-readable data added automatically

- Configurable invoice templates: Adapt to your country’s requirements, add custom fields, export in required format

- Multi-language and currency support: Perfect for cross-border business

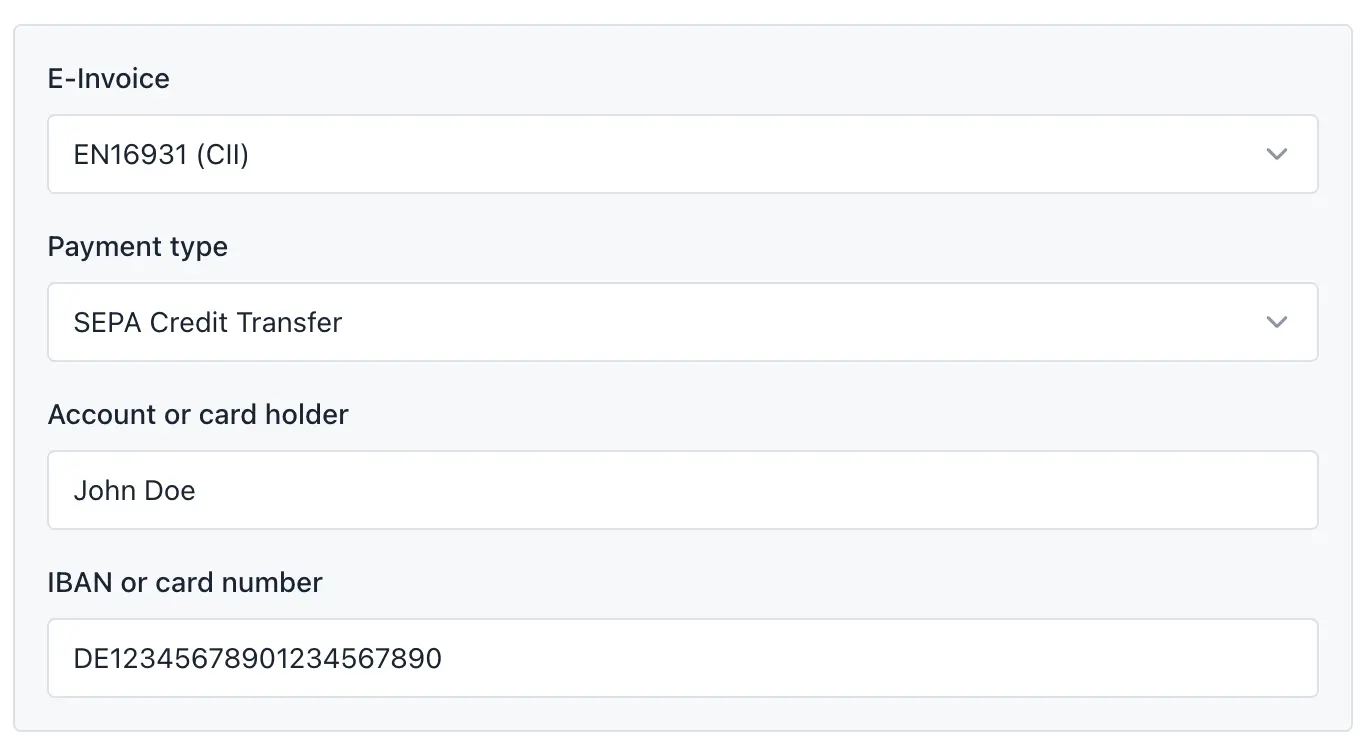

Kimai starts with a minimal set of features, covering most day-to-day use cases. You can currently configure a few typical payment types and your payment account.

Supported payment types and their official IDs:

- SEPA Credit Transfer (58)

- SEPA Direct Debit (59)

And you can configure the tax status and invoice template per customers:

- Taxable

- Tax-exempt (including reason)

- Reverse-charge (for cross-border invoicing)

Final Thoughts

E-invoicing is here to stay — and it’s quickly becoming a must for businesses in the EU.

With Kimai’s new e-invoicing feature, you can simplify compliance, save time, and focus on what you do best: running your business and enjoying the administrative tasks.

On-Premise users can purchase the plugin in the store.

Kimai

Kimai