E-invoicing in the EU: Is Your Business Ready?

Valentina

@ivalentinaIf you’re a business owner or self-employed professional working in an EU country, it is crucial that you understand e-invoicing and know whether you are compliant. Read our guide to find out when you should prepare and how to find the right solution for you.

The legal backbone: why E-Invoicing is becoming mandatory in the EU

Let’s start with the law, because nothing sounds more convincing as an “urgent business priority” than a new directive. EU Directive 2014/55/EU requires all companies and public sector organisations in member states to receive and process electronic invoices that comply with the European standard EN 16931. This forms the basis of e-invoicing for all business-to-government transactions.

But wait, there’s more! The EU’s VAT in the Digital Age (ViDA) initiative is about to raise the stakes. Under ViDA, e-invoicing will be mandatory for all cross-border B2B transactions within the EU, and invoices will need to be reported to the relevant tax authority within two working days of issuance. This means that paper invoices will soon become the exception rather than the rule, and member states will be able to enforce their own mandatory e-invoicing rules for domestic transactions (without having to ask Brussels for permission).

Businesses will therefore need to create structured, machine-readable e-invoices and report transaction data to tax authorities in near real-time. The aim of this shift is to create a standardised, interoperable system for digital invoicing across the EU, reduce administrative burdens and facilitate cross-border trade.

Short version, if you need it:

- B2B e-invoicing is rapidly becoming mandatory, with national rollouts accelerating ahead of the EU-wide ViDA deadline

- Your business needs a tool to make structured, machine-readable e-invoices

What is E-Invoicing, and why does it matter?

E-invoicing is the exchange of invoices in a structured digital format (think XML, not just PDFs) that allows for automatic processing by both businesses and tax authorities. This ensures faster payments, fewer errors, and most importantly keeps you on the right side of the law.

Why should you care as a business owner?

- Legal requirement: Non-compliance can lead to penalties (and nobody wants a letter from the tax office)

- Efficiency: Say goodbye to manual entry and hello to faster payment cycles

- Cost savings: No more paper, postage, or printer jams

- Compliance: Stay audit-ready

Who needs to get ready?

If you invoice other businesses (B2B) or public authorities (B2G) in the EU, you’re either already affected or will be soon. Even if your country hasn’t pulled the e-invoicing trigger yet, ViDA is coming for everyone, so start preparing now.

E-invoicing rules and timelines differ across the EU. Here’s a quick overview for ten countries (made in October 2025) as examples:

| Country | E-invoicing Mandate & Timeline |

|---|---|

| Germany | Receive e-invoices (EN 16931) from Jan 2025; mandatory issuing for large firms by 2027, full by 2028 |

| Austria | B2G e-invoicing required; UBL, CII, ebInterface; PEPPOL supported |

| Finland | Mandatory B2G e-invoicing since 2019 |

| France | Phased B2B rollout via PEPPOL/Chorus Pro; started Jan 2025 for medium size companies, all by Sept 2026 |

| Italy | Mandatory B2B e-invoicing since 2019 via SdI; micro-businesses included from Jan 2024 |

| Spain | B2B e-invoicing mandate via FACe platform, started in 2024 |

| Portugal | B2G e-invoicing required for all companies, including SMEs |

| Poland | Mandatory B2B e-invoicing from Feb 2026 via National Electronic Invoice System (KSeF) |

| Greece | B2G e-invoicing mandatory from June 2024 (EN 16931); B2B mandate expected July 2025 via myDATA |

| Belgium | B2B e-invoicing for domestic transactions mandatory from Jan 2026; real-time reporting by 2028 |

Important Note: Many other EU countries have voluntary or sector-specific e-invoicing requirements. Always check your local regulations for the latest details!

This table was created and double-checked in October 2025, any changes announced later possible

How to get compliant (and stay sane)

So, you want to avoid fines and keep your accountant happy? Here’s what every savvy business owner should do:

- Research and choose the right e-invoicing solution: Because who doesn’t love spending hours comparing software features and reading user reviews?

- Obtain recipient consent: Yes, you still need to make sure your customers are cool with e-invoices-at least until ViDA makes it universal.

- Test and train your team: Nothing says “smooth transition” like a team that knows what an XML file is (and isn’t afraid to use it).

- Ensure data integrity and security: Cybercrime loves invoices. Make sure your data is stored securely for those inevitable audits.

- Comply with national standards: EN 16931 is the EU baseline, but your country might have its own quirks. Because, of course, they do.

Kimai’s new E-Invoicing feature: compliance made easy

With the new plugin and soon in the Cloud, Kimai supports e-invoicing, so you can stop worrying about invoice formats and start focusing on your business.

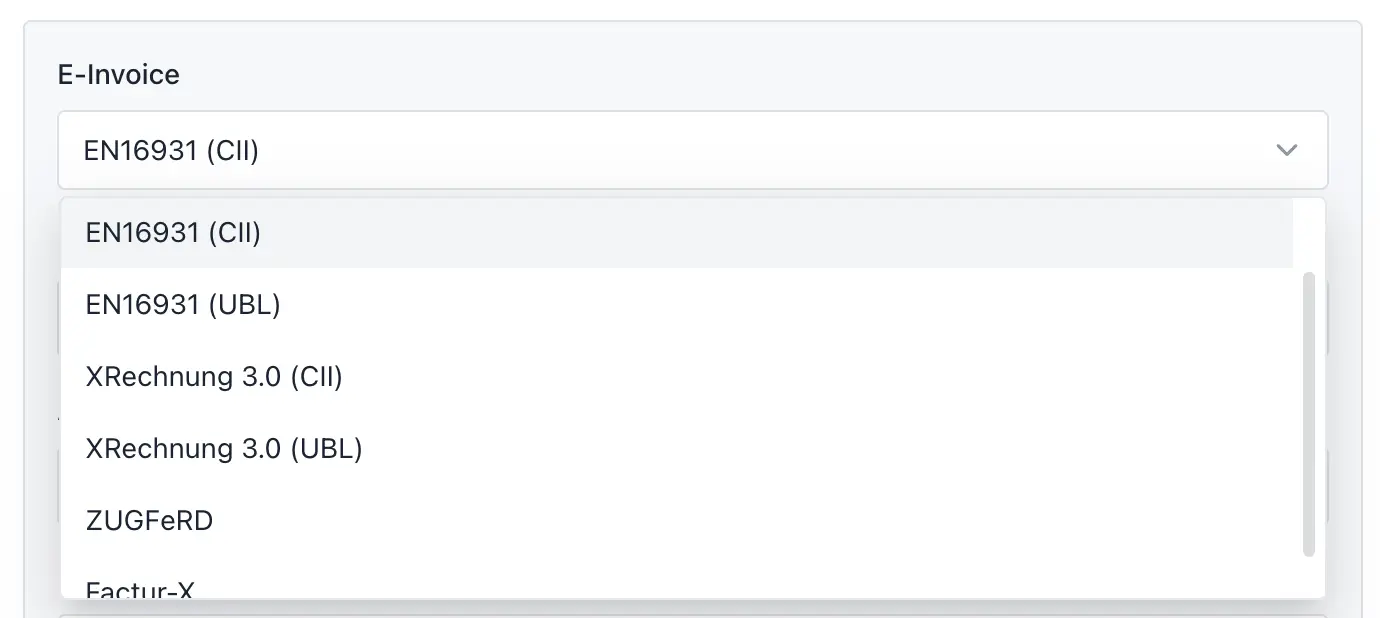

The supported profiles are:

- EN16931 - CII (XML)

- EN16931 - UBL (XML)

- XRechnung 3.0 - CII (XML)

- XRechnung 3.0 - UBL (XML)

- Zugferd (PDF/A hybrid with embedded XML)

- Factur-X (PDF/A hybrid with embedded XML)

Key features for EU businesses:

- Automatic e-invoice generation: Create invoices in PDF via plugin or in Kimai Cloud, the required machine-readable data will be created and/or added automatically

- Configurable invoice templates: Adapt invoices to your country’s requirements and customer preferences, add custom fields like location, breaks, export in required format

- Multi-language and currency support: Perfect for cross-border business

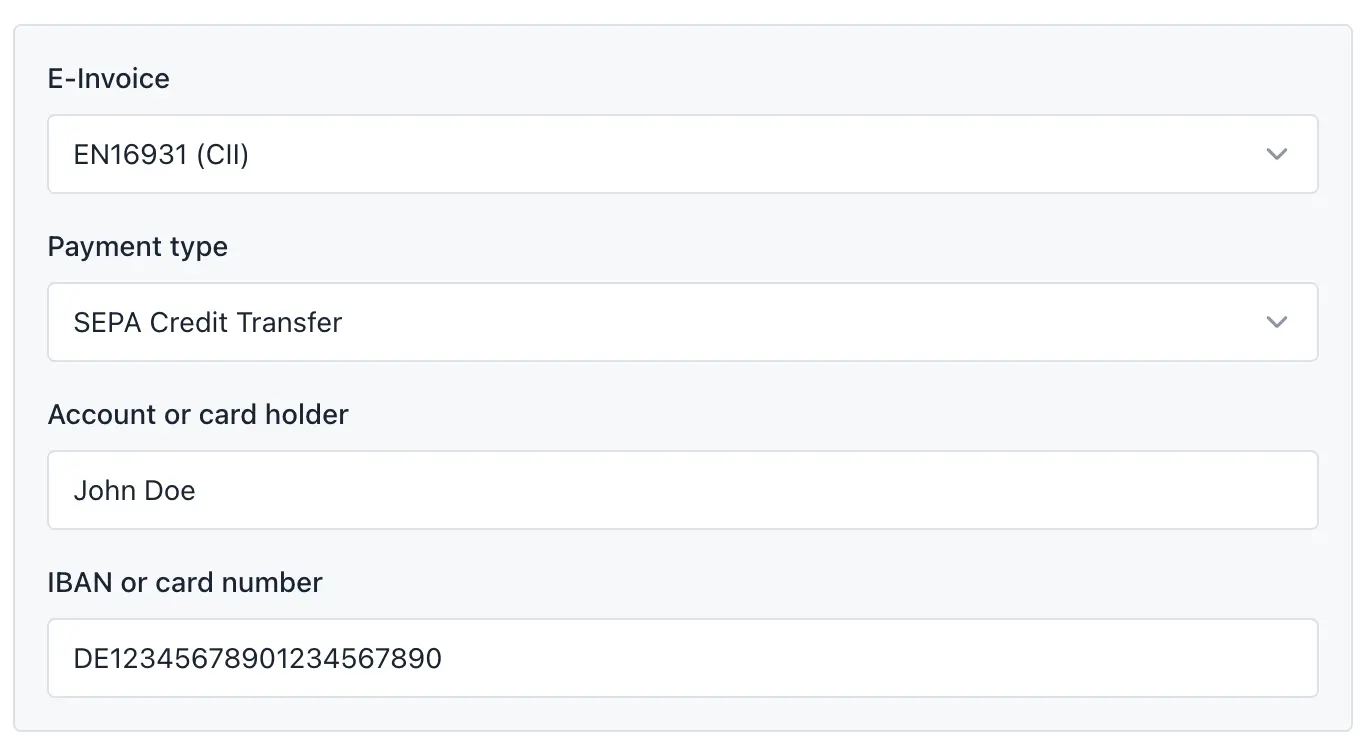

Additional features for e-invoicing:

Kimai starts with a minimal set of features, which should already most day to day use-cases. That’s why you can currently (only) configure a few typical payment types and your payment account:

Supported payment types and their official IDs:

- 58: SEPA Credit Transfer

- 59: SEPA Direct Debit

- 30: Credit Transfer

- 49: Direct Debit

- 42: Payment To Bank Account

- 48: Card Payment

- 10: Cash

Final thoughts

E-invoicing is here to stay, and it’s quickly becoming a must for businesses in the EU. With Kimai’s new e-invoicing features, you can simplify compliance, save time, and focus on what you do best: running your business (and maybe even enjoying it). On-Premise user can purchase the plugin in the store.

Ready to join? Try Kimai Cloud for free today and make e-invoicing one less thing to worry about.

Kimai

Kimai